Individual disability insurance is truly a basic concept. It is an insurance product designed to replace anywhere from 45-60% of your gross income on a tax-free basis should a sickness or illness prevent you from earning an income in your occupation. Every disability insurance policy from every insurance company is very different; this is not a product to simply shop for the most competitive rate. To buy the cheapest disability insurance policy on the market is to throw money away. The odds of getting paid a monthly benefit under a cheap contract may be significantly lower than receiving benefits from a quality contract.

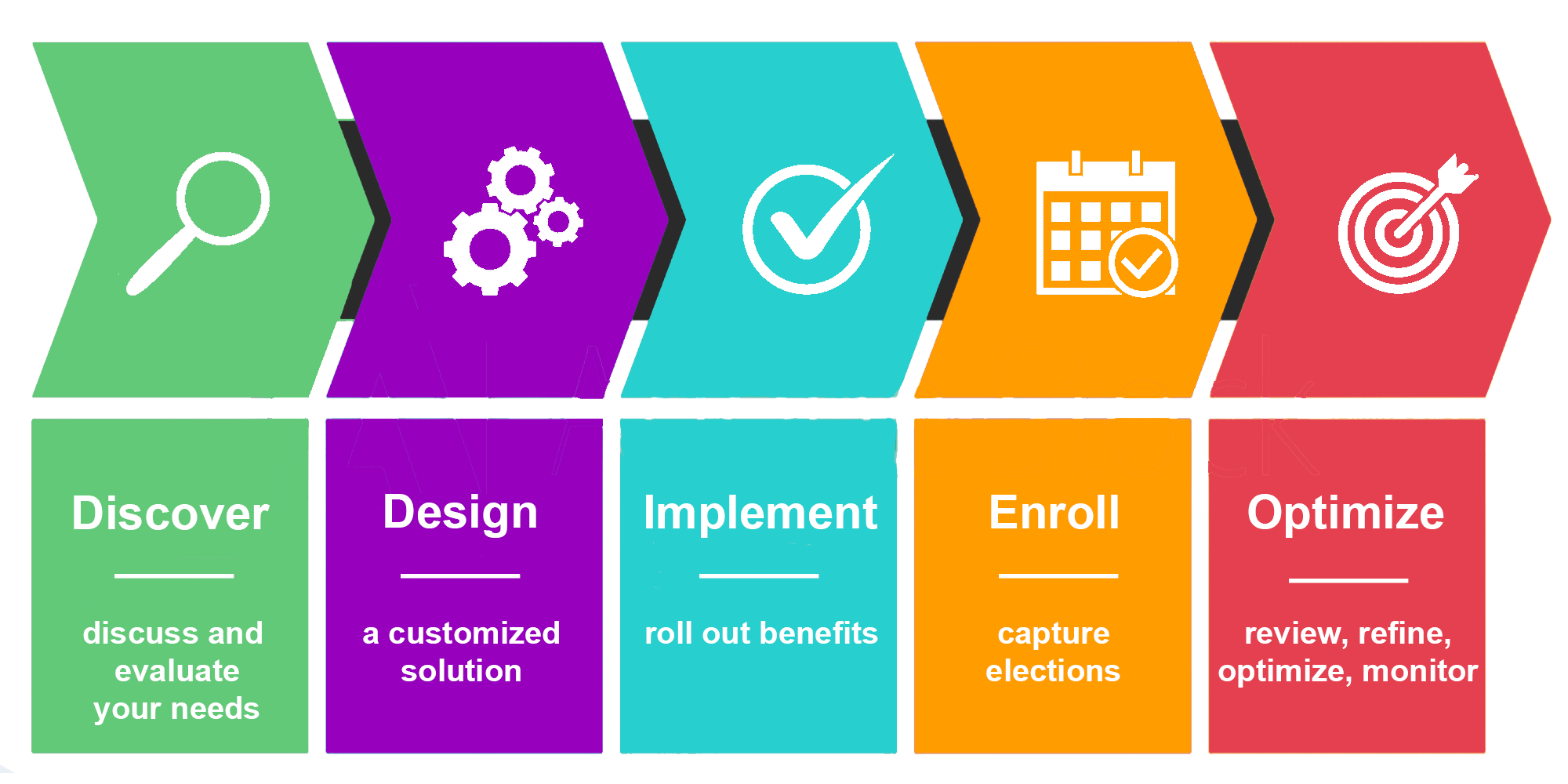

We’ll help you choose the right disability plan for your business and your employees.

You can choose from two types of disability coverage: short-term and long-term. When you partner with us, we’ll go over your unique needs to see which policies suit your company, then we’ll guide you through the features and benefits of each policy. Armed with that info, you’ll be able to decide which plan best fits your business. You’ll give your employees added peace of mind and another powerful reason to join and stay with your company.

Short-term disability starts when your workers are unable to work due to sickness, injury, or birth of a child. It typically lasts 10 to 26 weeks.

Long-term policies can replace up to 60% of salary and last for a certain number of years or until the employee reaches retirement age. The longer the benefit period, the higher the premium.

47% of U.S. employers offer short-term coverage and 40% provide long-term disability, according to industry trade group LIMRA. We’ll help you decide whether you need short-term, long-term, or both, and how much you need. We’ll make sure you choose the plan that offers the right level of coverage for your employees.

If the company pays all or part of the premium, that’s likely the best option for employees to start with. They benefit from lower group costs as well as reduced premiums.