At the end of 2019, the federal government reauthorized annual fees paid by health insurers and group health plans into the Patient-Centered Outcomes Research Trust Fund (PCORTF) through 2029. These fees support the Patient-Centered Outcomes Research Institute (PCORI), created by the Affordable Care Act in 2010 to fund research that helps patients and providers make better-informed healthcare decisions.

📅 Key Deadline: July 31, 2025

Plan sponsors must submit the PCORTF fee via IRS Form 720 by July 31, 2025, for plan years ending in 2024.

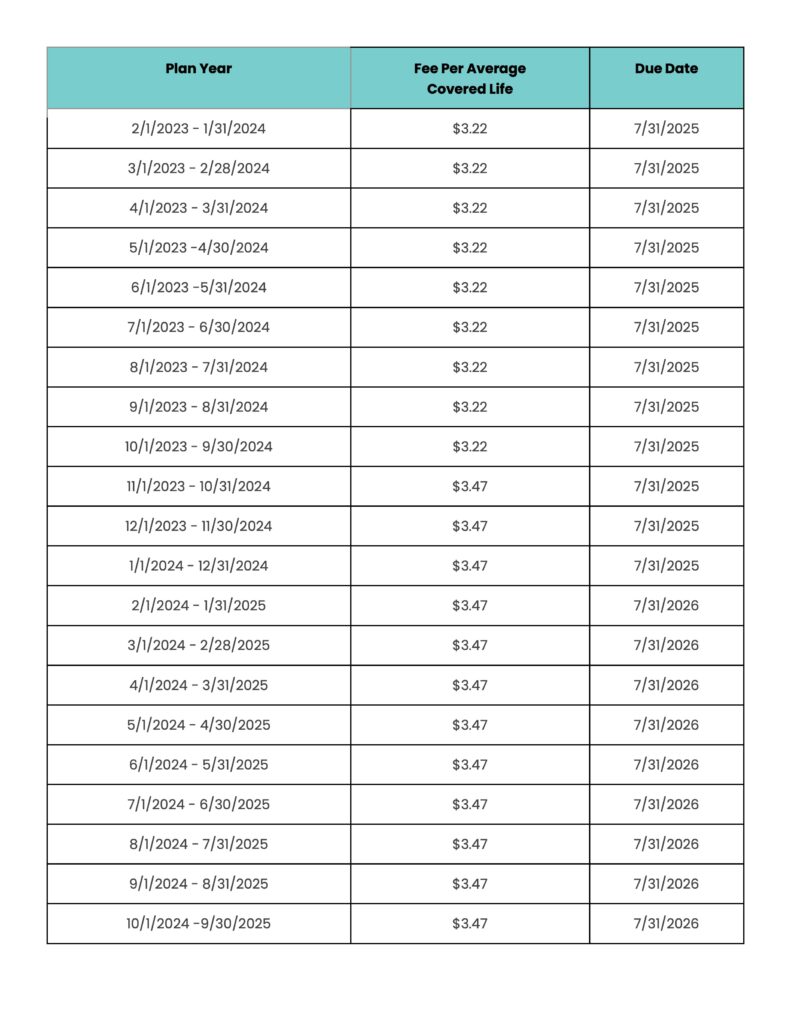

💵 2025 and 2026 PCORI Fee Amounts:

The fee is calculated by multiplying the average number of covered lives (employees and dependents) by the applicable rate based on your plan year end date.

For ease of reference, the following chart outlines the applicable fees that must be paid in 2025 and 2026 based on the plan year start dates:

📑 How to File

Plan sponsors report and pay the fee using IRS Form 720 — but only once a year with the second-quarter filing deadline of July 31. Even though Form 720 is generally a quarterly form for federal excise taxes, you only need to file it for PCORTF fees in the second quarter.

📝 Download the current forms here:

Pro Tip: Zinn recommends the snapshot count method to determine the average number of covered lives during the plan year for accurate reporting.

✅ Stay Compliant with Confidence

If tracking deadlines and navigating benefits compliance feels overwhelming, Zinn Insurance can help. Our experts specialize in benefits administration, reporting, and compliance solutions customized for your business.

Contact us today to learn how we can simplify your compliance process.