In the event of your untimely death people purchase life insurance is a financial product you purchase to protect your family. Many people purchase life insurance to provide money to cover out of pockets costs for medical, funeral expenses, replace wages, cover mortgages and to cover college expenses for their children. Life insurance allows you to sleep at night knowing your family will not be in financial ruins at the time of your death.

Having the right life insurance is a key element in planning for the future of you and your loved ones. Life insurance can help you fulfill the promises you’ve made your family when you are gone.

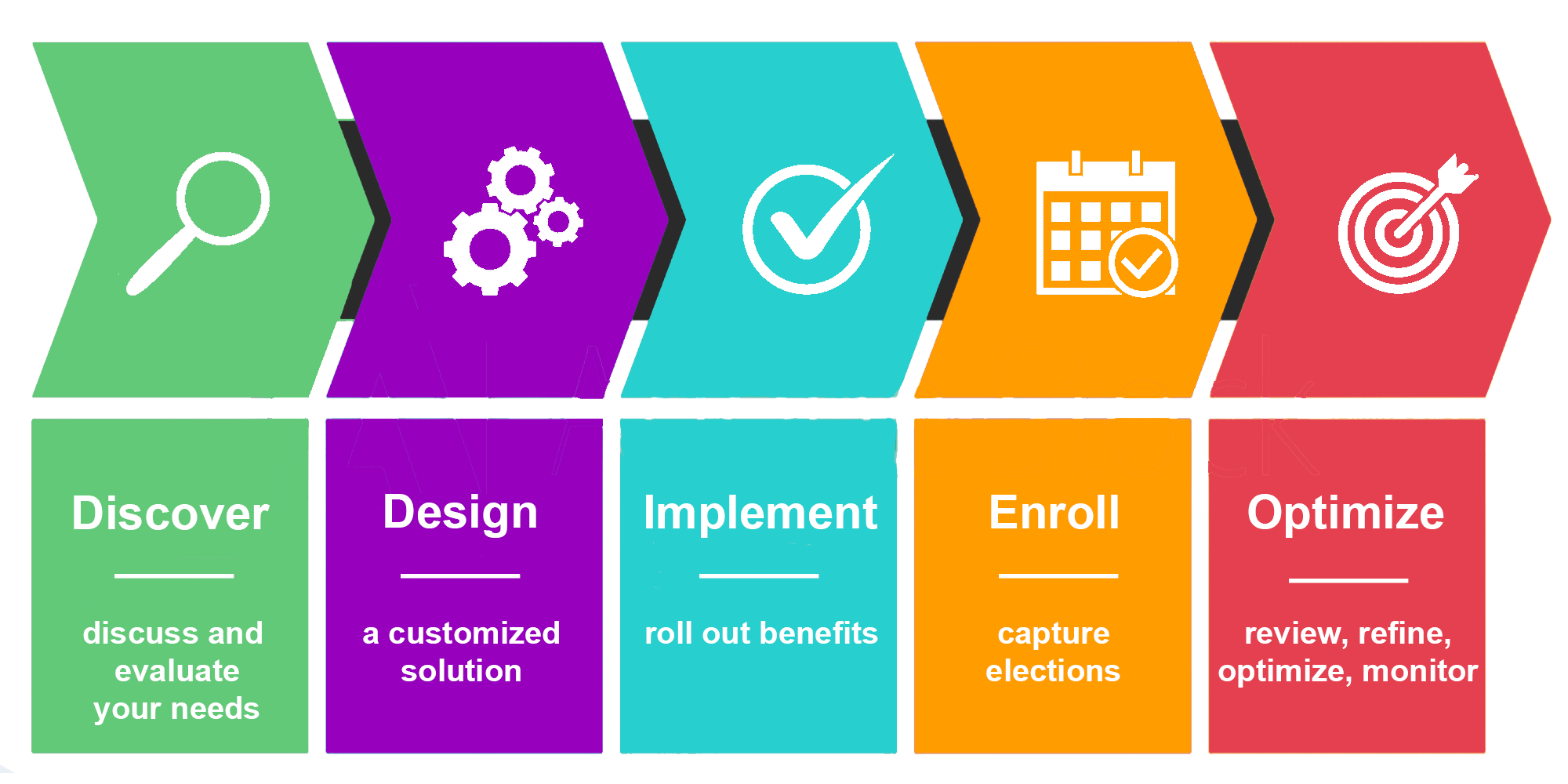

Do not leave the future of you and your loved ones to chance. Zinn Insurance can help you find the right coverage and help ensure that your policy continually meets your needs.

The right life insurance will be unique to each client and depends on personal and financial needs. As life changes, your life insurance coverage should adapt to your current needs. Some life changes that may require a policy “tune-up” include:

Having the right life insurance is essential to planning for your present and future. Many life insurance options offer other benefits and investment opportunities you can take advantage of while you are living and provide assurance for your family after you are gone.

Life Insurance Death Benefit – When you pass away, your life insurance provides income (tax-free) to your named beneficiary or beneficiaries that can be used to pay funeral expenses, debt, tuition, estate taxes, or virtually any financial need. Your policy can help provide security for your business as well, by enabling partners to buy out the interests of a deceased partner and prevent a forced liquidation.

Living Benefits – The cash value growth of a permanent (whole) life insurance policy is tax-deferred, meaning you do not pay taxes on the growth of cash value, unless money is withdrawn. Loans or withdrawals can be taken against the cash value of a permanent life insurance policy to help with expenses, such as college tuition or the down payment on a home.

The right life insurance coverage for each and every one of our customers in Texas is unique. Contact the Zinn Insurance team today to find out how to protect your family and your future with the right life insurance.

Why would anyone get insurance any other way? This was an amazing experience.

We went to see Monique (The Owner) and was floored by the incredible customer service, her thorough walkthrough of all the plans to make choosing easier and the speed in which we signed up for all insurance. We were literally in and out of the office (a beautiful residential area by the way), within 1 hour and 10 minutes. Thats not bad for being a first time business owner, 26 years old and having my brother with me looking at vision, dental and health at the same time.

She was courteous, polite, caring and gave us options that she had already prepared before we arrived. It was such a great luxurious service that I started to worry about how much this would cost, I was prepared to invest because she absolutely deserved it, but numbers started to fly around.

When she told me that it was free because she gets a commission from any packages she recommends our jaws dropped. Not only that but we can call her if we have any questions at all, change our primary through her and change policies on the fly making everything super easy and insurance a lot more fun to deal with, instead of dreading it.

Her character was bright, sunny and fun making the entire transition a wonderful experience. I highly highly recommend her and you’d honestly would have to be crazy not go with Zinn Insurance!