Many people get health coverage through their employer. This is called group coverage. Employers may offer several plans to choose from, and employees get a chance to change their plan once a year during open enrollment.

Some people purchase their own coverage because it is not available through their employer. This is called individual health insurance coverage. Individual health insurance coverage is a good option for people who are:

Some Americans receive health coverage through government programs. Some examples of government health programs are Medicare, Medicaid and other programs run by individual states.

Health insurance plans come in all shapes and sizes. That’s why it’s important to assess your needs before you choose an insurance plan.

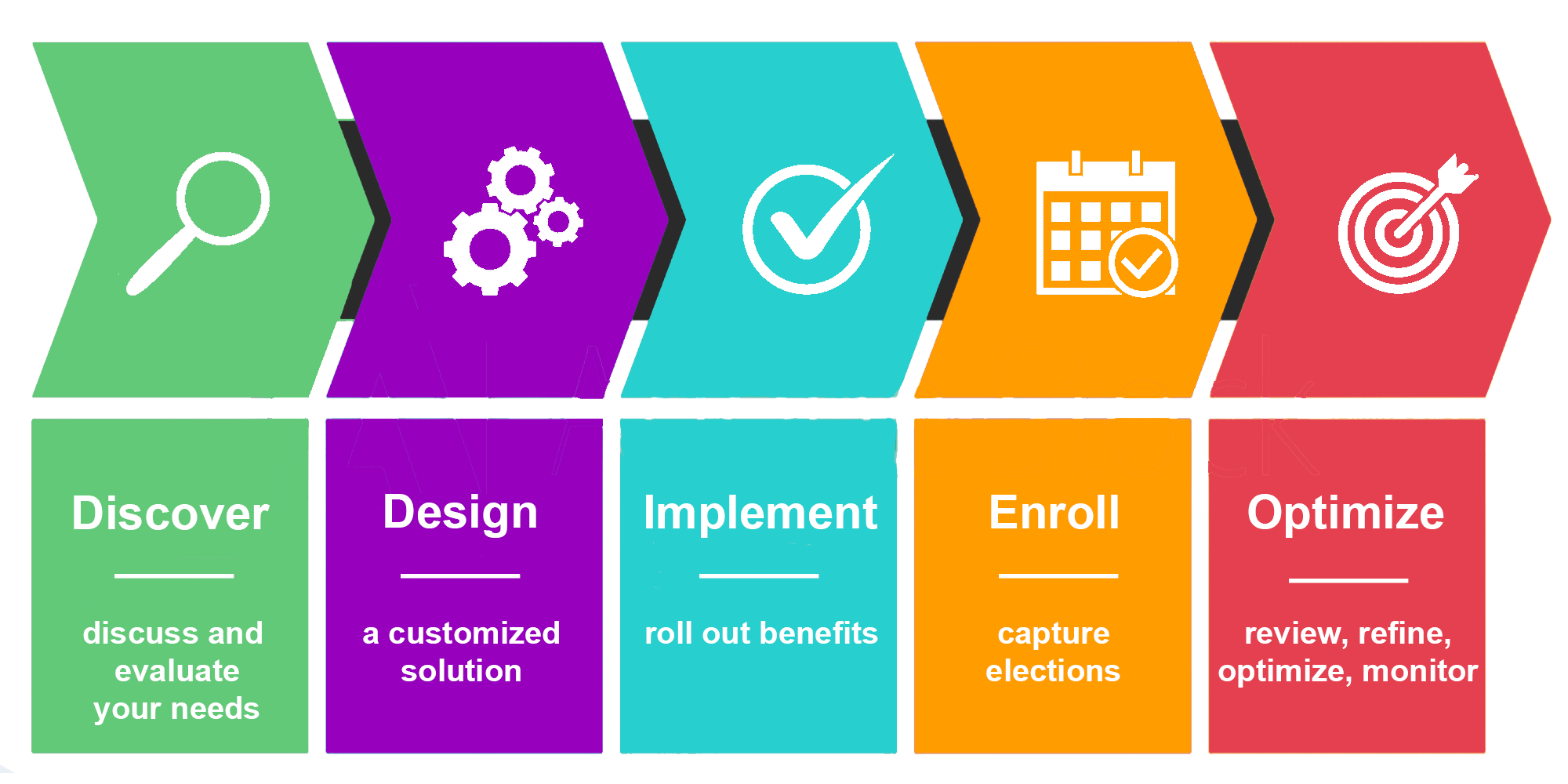

We take our clients though a 5 step process.

Insurance plans come in all shapes and sizes. That’s why it’s important to assess your needs before you choose an insurance plan.

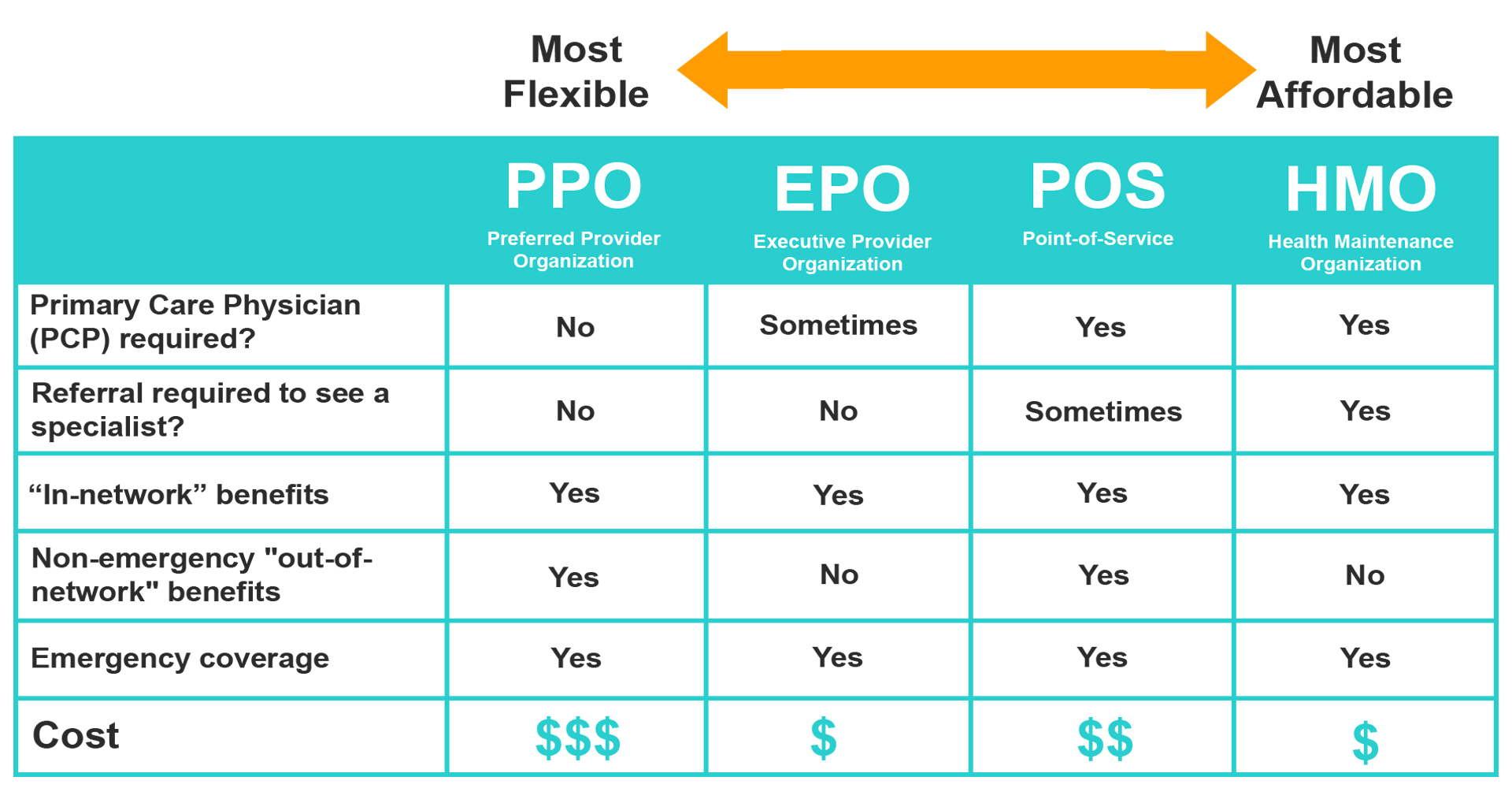

HMOs, available through participating employers, are a type of health plan that gives you access to certain doctors and hospitals, often called network or contracting doctors and hospitals (sometimes called “providers”).

HMO Basics: When you sign up, you select a primary care physician (PCP) from a network of doctors. Your PCP is your first point of contact for most of your basic health care needs. Women can also select an OB/GYN for obstetrical and gynecological care. If you need special tests or need to see a specialist, your PCP will give you a referral to see another doctor. Learn more from Blue Cross Blue Shield: HMO Rights and Responsibilities

The Bottom Line: HMO plans generally have lower up-front costs, or premiums, than other types of plans. HMOs usually feature copayments as well. Copayments are set amounts (usually a dollar amount or a percentage) that you pay for care. An example of a copayment is $20 for each office visit. HMO plans generally provide coverage only when you use doctors, hospitals and specialists that are in the network. If you seek care outside the network, other than in an emergency or with authorization from your HMO, your care typically will not be covered at all.

Like HMOs, PPOs often feature a network of doctors, specialists and hospitals; however, there are some key differences between the two types of plans.

PPO Basics: With a PPO insurance plan, you don’t have to choose a primary care physician. You have the option of receiving care from doctors, hospitals and specialists in the network or outside the network, and you don’t always need a referral to see a specialist.

Key Features: PPO insurance plan premiums are generally higher than HMO plans, which means you’ll have to pay more up front. When you receive care from a doctor or hospital that is in the network, your costs tend to be lower. When you receive care from a doctor or hospital outside the network your costs are likely to be higher, and you may be responsible for the difference between the amount your insurance plan pays and the provider’s billed charges. PPO insurance plans usually have a deductible. So, for example, if your PPO insurance plan has a $500 deductible, your coverage doesn’t begin until you’ve paid out-of-pocket for the first $500 of your own medical expenses. Preventive care services are not subject to the deductible.

Consumer Driven Health Plans (CDHPs) often involve pairing a high deductible PPO insurance plan with a tax-advantaged account, such as a Health Savings Account (HSA)1. For an individual to establish an HSA and contribute money to the account each year, he or she must be considered an HSA-eligible individual. Eligibility includes enrollment in an HSA-qualified high deductible health insurance plan. Learn more from Blue Cross Blue Shield – Guidance on choosing a health insurance plan: U.S. Agency for Healthcare Research and Quality (AHRQ)

Key Features: If the insurance plan uses a PPO network, you don’t have to choose a primary care physician You have the option of receiving care from doctors, hospitals and specialists in the network or outside the network, and you don’t always need a referral to see a specialist.

The Bottom Line: When a CDHP includes a high deductible health insurance plan, premiums are often lower than other types of health plans because you are responsible for a greater share of your health care costs.

HSAs are type of savings account that allows you set aside money on a pre-tax basis to pay for qualified medical expenses. The untaxed dollars in a Health Savings Account (HSA) can be used to pay for deductibles, copayments, coinsurance, and some other expenses, however, generally may not be used to pay health insurance premiums.

When you view plans in the Marketplace, you can see if they’re “HSA-eligible.”

HSA Contributions:

HSA funds roll over year to year if you don’t spend them. An HSA may earn interest or other earnings, which are not taxable.

We are a full-service insurance agency. We offer a professional approach to meet the insurance needs of businesses, individuals, and seniors. We offer a FREE, no obligation consultation to review the current policies of your business and personal needs.

Why would anyone get insurance any other way? This was an amazing experience.

We went to see Monique (The Owner) and was floored by the incredible customer service, her thorough walkthrough of all the plans to make choosing easier and the speed in which we signed up for all insurance. We were literally in and out of the office (a beautiful residential area by the way), within 1 hour and 10 minutes. Thats not bad for being a first time business owner, 26 years old and having my brother with me looking at vision, dental and health at the same time.

She was courteous, polite, caring and gave us options that she had already prepared before we arrived. It was such a great luxurious service that I started to worry about how much this would cost, I was prepared to invest because she absolutely deserved it, but numbers started to fly around.

When she told me that it was free because she gets a commission from any packages she recommends our jaws dropped. Not only that but we can call her if we have any questions at all, change our primary through her and change policies on the fly making everything super easy and insurance a lot more fun to deal with, instead of dreading it.

Her character was bright, sunny and fun making the entire transition a wonderful experience. I highly highly recommend her and you’d honestly would have to be crazy not go with Zinn Insurance!